Amid rapid globalization, Americans have faced new pressures when it comes to economic change, leading to abundant prosperity, as well as significant pain and disruption across communities.

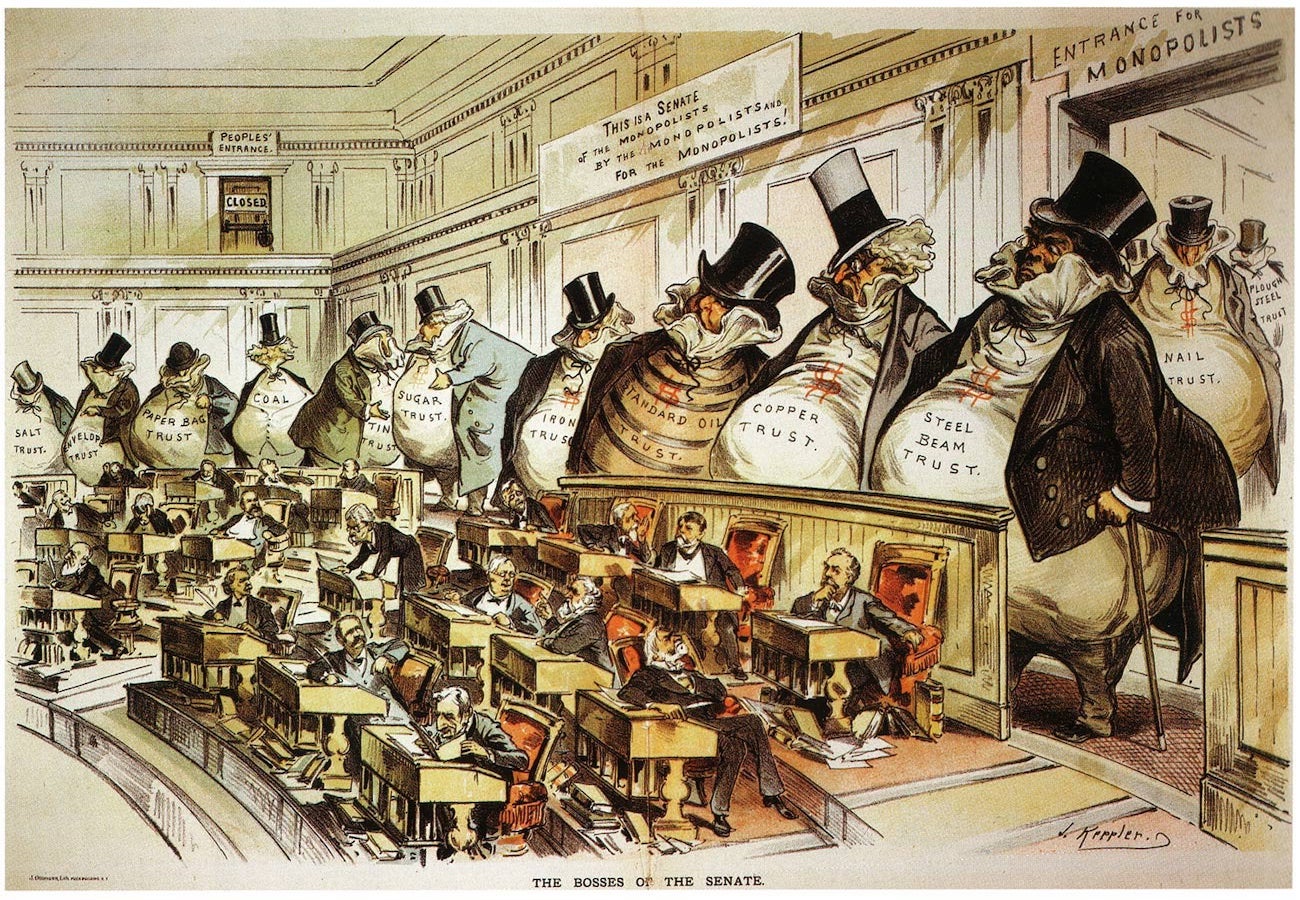

In search of a villain, populists and progressives routinely blame the expansion of free trade and rise of global conglomerates, arguing that entrenched and moneyed interests are now allowed to run rampant from country to country with little competition or accountability.

In search of a solution, those same critics tend to relish in nostalgia, either reminiscing about the economic security of postwar industrialism or the hands-on administrative gusto of the Great Society. Economic change is viewed not as an opportunity for improvement, but as a threat to be managed and mitigated against through tariffs, price controls, or other regulatory fixes.

But while such measures surely aim to slow or subvert the consolidation of power, we increasingly see that economic interventionism is likely to have the opposite effect – further entrenching “globalist elites” and restricting smaller competitors through a quiet cronyism of sorts.

According to a new study from economists Mara Faccio and John McConnell, the biggest threat to fair and dynamic competition is not the “bigness” of a firm in and of itself, but rather its alignment with political power, restrictionist trade policy, and protectionist regulatory regimes.

Drawing from economist Joseph Schumpeter’s theory of creative destruction – a process through which firms and industries are naturally replaced by newer and better entrants – the authors first explore to what extent such a process is actually at work in modern economic life. Using newly assembled data from up to 75 countries, they observe the 20 largest firms in each country at various intervals (from 1910 to 2018), giving “the Schumpeterian process an abundance of time to create and destroy.”

Their conclusion: Overall, the process of creative destruction is mostly alive and well, even in modern global capitalism. For a small taste, consider the following data visualization (which is not referenced in the study):

Yet throughout the same 100-year period, the researchers also identified a significant number of exceptions:

Consistent with Schumpeter’s proposition, worldwide, the replacement of old large firms with the other large firms is the norm in each of the time periods considered. However, contrary to Schumpeter’s proposition, exceptions are not rare. Exceptions represent 13.6% of the 20 largest firms in each country over the century-long time period, increasing to 25.0% of the largest firms over the four-decade period of 1980-2018, and increasing further to 43.8% of the largest 20 firms over the nearly two-decade interval of 2000-2018.

So, why were some large companies able to perpetually withstand external competition?

Faccio and McConnell consider a range of popular explanations, from the nature of a company’s innovative culture to its network of embedded money trusts. In the end, however, political entrenchment emerged as the leading determinant.

“The results show a statistically and economically large impact of political connections, but only limited roles for innovation and board interlocks,” they explain. In an “unimpeded” context, “creative destruction of large firms is likely to prevail,” but “to the extent that it does not, the data suggest that it is because the political process impedes entry.”

As far as how that cronyism tends to manifest, the authors provide in-depth analysis on a number of intersecting areas.

On the role of political connections:

Being politically connected circa 1910 increases the likelihood of a large firm continuing to be one of the 20 largest firms in its country over 100 years later by 11.5 percentage points, a result that is both economically and statistically significant. The relation between political connections and a large firm becoming or remaining among the largest 20 over the interval of 2000-2018, the other interval for which we have data on political connections, is also statistically significant and economically large … How is it that political capture protects large firms from encroachment by competitors? … Presumably, as in Zimbabwe, it is by establishing regulatory barriers to entry.

On the role of trade protectionism:

A necessary condition for weak firms to remain large is that cross-border entry be limited. … We propose that cross-border competition requires open borders to trade and access to capital. We investigate whether politically connected firms are disproportionately more likely to remain large when regulatory barriers to cross-border entry and to cross-border capital flows are in place.

We find that they are. Specifically, our tests show that openness to cross-border capital flows and openness to cross-border trade reduce the ability of politically connected incumbents to remain dominant over extended periods of time. These results are consistent with regulatory barriers to entry and barriers to cross-border capital flows being mechanisms that allow politically connected firms to impede the Schumpeterian process. …

When an economic system is open to both cross-border trade flows and cross-border capital flows, it is likely to be difficult for domestic politically connected firms to entrench their positions by suppressing foreign entry.

On the role of regulatory barriers:

Within countries, large incumbent firms are replaced by new large firms. Despite the salutary benefits of the process, we find evidence of factors that systematically impede it from occurring. In particular, when the demand for regulatory protection is met by the supply of regulations that protect incumbents from entry, large incumbent firms connected to politicians tend to remain dominant for decades if not centuries.

Our study connects to prior research on the effect of barriers to entry on the start up of new businesses, the role of political connections in shaping regulatory decisions affecting business firms, and the role of political connections and bank-board interlocks in affecting preferential access to capital …

The important conclusion is that political connections facilitate the ability of big companies to remain or become big only when their home country is closed to both trade and capital flows. The presence of regulatory barriers to entry appear to be a necessary condition for politically connected firms to remain or become dominant.

In surveying such evidence, one might be frustrated that the very policies touted as solutions likely do the most to inhibit healthy challenges to “the system.” Yet in a different light, the study also reminds us that not only is the real solution already at work, it is prevailing.

Even in countries with different governmental frameworks and policy structures, across diverse periods of time, human persons have successfully created, collaborated, and innovated their ways to newer and better enterprises and institutions. This has all come despite those ongoing “exceptions” of political privilege. When an economic powerhouse ceases to serve the public interest, we do not need political power and regulatory tricks to level the field.

Such evidence does not take away the pain of economic change, of course, nor does it remove the prospect of ongoing technological disruption. For many, the persistence of “natural” creative destruction will not be encouraging; it will only affirm their fears about what is to come. But given the alternative, one wonders how the select cronyism of political elites would serve us any better.

Such destruction is deemed “creative” for a reason: because it “incessantly revolutionizes the economic structure from within,” as Schumpeter put it. When it comes to checking collections of entrenched power, the internal revolution is a far more reliable mechanism, which ought to give plenty of empowerment and encouragement to innovators and institutions of all shapes and sizes.