Previously this week, The Wall Street Journal presented a list of “7 Things Investors Should Be Watching for a 2016 Unfolds.” While there’s much in Michael A. Pollock’s article to recommend it to readers who might’ve missed it, there’s also one significant omission – Number Eight, if you will: A Rise in Proxy Resolutions by Religious Shareholder Activists.

Shortly after reading the WSJ article, your writer received an email from the Interfaith Center on Corporate Responsibility, the “corporate God-flies” who mask an actual leftist political agenda with their supposed faith-based concerns over social issues related to climate change and corporate spending on lobbying and politics. ICCR’s email announces the group’s increased efforts to stymie the best interests of the companies in which they invest in 2016 – without mentioning how their activities also negatively impact fellow shareholders as well as company customers and employees. Yet ICCR is undeterred in its efforts in a year thus far beset upon by great economic uncertainty and volatility:

Shareholder proposals on climate change and corporate lobbying and political spending head the list of 257 resolutions filed by ICCR members at 174 companies in the 2016 proxy season. Over one-third of total proposals this year are climate-related, including those related to corporate lobbying, revealing how climate change is viewed as a major risk for investors and engagements on how companies are mitigating these risks are taking on greater importance.

And this:

ICCR members filed a record 91 resolutions addressing climate change this year, more than any other time in their history. Fifty-two of these dealt primarily with climate change, while an additional 39 addressed climate change indirectly via other strategies including governance, deforestation and recycling.

And this:

During the most expensive presidential campaign in history, ICCR members filed 62 resolutions requesting disclosures around corporations’ use of funds to support lobbying and political activities – including spending through PACs and trade associations seeking to undermine climate change regulation.

And, finally:

Aye yi-yi. I doubt it’d do any good, but perhaps the ICCR and its religious shareholder activist cohorts over at As You Sow should read of the perils facing investors this year as noted by Pollock:

If January signaled what the stock market is going to be like in 2016, fund investors could face a gut-wrenching year.

Worries about China and the global economy, a surging dollar and oil’s collapse helped send the S&P 500 index down 5.07% in January, the market’s worst performance for that month since the 2009 financial crisis. The poor start came after the index’s six-year winning streak ended in 2015. What’s more, stocks may not have seen the lows for this correction yet, money managers caution.

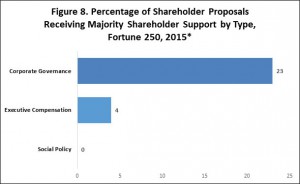

Pollack continues: “It can be scary to own stocks when markets are gyrating.” Even scarier when ICCR and its religious, progressive cohorts undermine businesses from within at the same time they face mounting economic turmoil from without, especially when the social issues they promote haven’t garnered any traction in the past nine proxy shareholder seasons. According to the Manhattan Institute’s James R. Copland, “not a single [2015] social-policy-related shareholder proposal has received the support of a majority of shareholders over board opposition.”

And yet, the efforts of ICCR and AYS continue to distract company board members and shareholders from the core functions of their respective businesses. Not because any of their efforts stem from any legitimate religious concern, but only from leftist political ideology.