Bitcoin is dead, long live Bitcoin.

Bitcoin is dead, long live Bitcoin.

A few weeks ago the IRS killed off any chance that Bitcoin could become a mainstream currency. That’s probably for the best since it clears the way for it to become something much more important: the world’s first completely open financial network.

Timothy B. Lee has a superb article explaining why this could be transformative. Lee highlights one particularly helpful innovation:

One obvious application is international money transfers. Companies like Western Union and Moneygram can charge as much as 8 percent to transfer cash from one country to another, and transfers can take as long as 3 days to complete. In contrast, Bitcoin transactions only take about 30 minutes to clear, and Bitcoin transaction fees could be a lot less than 8 percent.

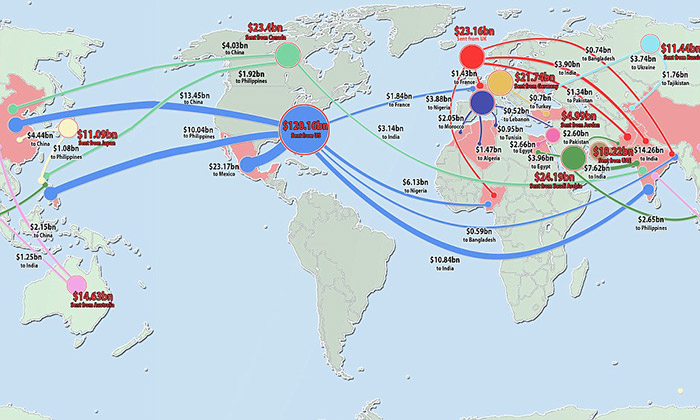

An “alternative to Western Union” doesn’t sound revolutionary, does it? Now look at this graphic produced by The Daily Mail which shows how much money is being sent by migrants to their families back home.

In 2012, the total transfers topped $530 billion, but World Bank officials believe the amount could be billions more because not all cash is sent through banks and money transfer companies on which the figures are based.

The economic impact of these remittances is extremely important to developing countries. The African diaspora—nearly 140 million Africans live abroad—is such a major source of foreign income that it now outstrips foreign aid sent by Western donors. The money these expatriates send back home is collectively worth far more than the development donations sent by Western financial institutions. Likewise, for dozens of developing countries, such as Bangladesh, Guatemala, Mexico and Senegal, remittances are worth more than the aid they receive from other countries.

Unfortunately, about $7 billion a year never makes it into the African relatives’ accounts because of high bank fees. Add up all the fees across the globe, and you have tens of billions of dollars that are going to banks and money transfer companies rather than directly into the pockets of some of the world’s poorest peoples.

Last year I wrote that rather than lobbying governments to increase foreign aid to poor countries we need creative entrepreneurs who can find a free market solution to the exorbitant transaction costs. Bitcoin may be able to provide that solution. Using Bitcoin NGOs and charities could establish an open payment network based on conventional currencies. Even if they charged 1-2% fees to cover their costs it would still mean that billions more in direct aid from expatriates to their family and friends in developing countries.

As a currency, the story of Bitcoin is likely to become nothing more than a footnote in obscure economic journals. But if Bitcoin becomes widely used as an inexpensive means of transferring funds around the globe, it could become something far more significant: one of history’s most revolutionary advances in developmental economics.