Throughout the COVID-19 crisis, America’s planning class has relied on a predictable mix of so-called stimulus and monetarist tricks to curb the pain of economic disruption. Such heavy-handed interventionism has long been misguided, but for many, the government’s efforts have not gone far enough.

Last spring, California Gov. Gavin Newsom talked of exploiting the pandemic as a way to “reshape how we do business and how we govern,” leading us into a “new progressive era.” Others, like Bernie Sanders and Alexandria Ocasio-Cortez, have gotten more specific with their proposals, trying to connect the particular problems of the pandemic with generic lists of progressive policy aims, from universal healthcare to “free” college and housing.

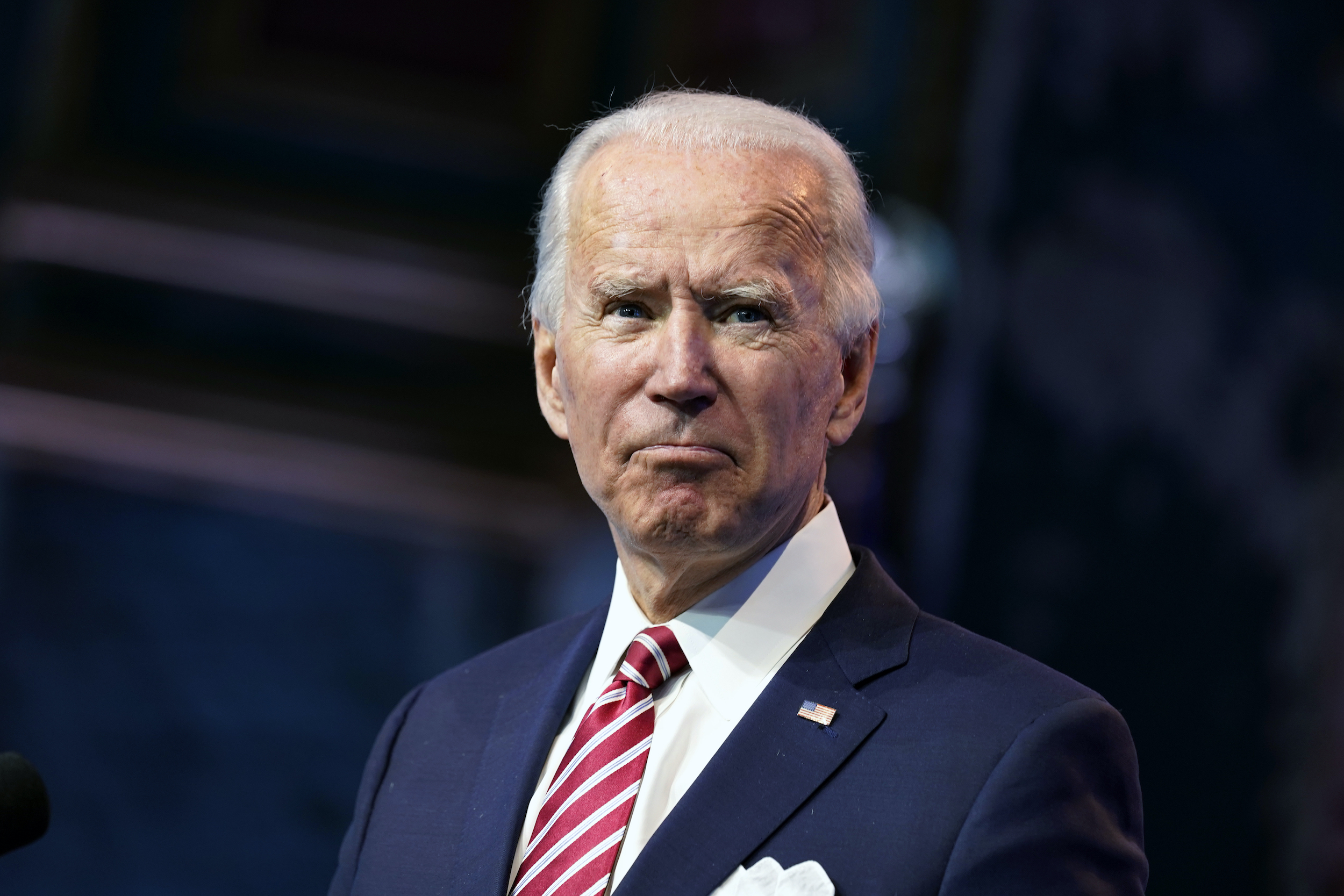

In the final presidential debate, Joe Biden did much of the same, arguing that a $15 federal minimum wage was necessary not for its general merits, but because it would serve as a form of economic relief for service workers suffering amid the pandemic.

“People are making six, seven, eight bucks an hour,” Biden said. “These first responders we all clap for as they come down the street because they’ve allowed us to make it – what’s happening? They deserve a minimum wage of $15. Anything below that puts you below the poverty level.”

Unfortunately, despite the lofty rhetoric and Biden’s routine claims that top-down price controls are somehow “empowering” or “dignifying,” these initiatives would do very little to help low-skilled workers and would be far more likely to inflict significant harm.

As economist Michael Strain points out, such proposals have proven problematic in times of plenty, never mind a moment such as ours, where employers are facing new pressures and service workers are competing harder than ever for employment:

In July 2019, the nonpartisan Congressional Budget Office estimated that a $15 minimum wage would eliminate 1.3 million jobs. The CBO also forecast that such an increase would reduce business income, raise consumer prices, and slow the economy.

The U.S. economy will be very weak throughout 2021. The nation will need more business income, not less; more jobs, not fewer; and faster, not slower, economic growth. A $15 minimum wage would move the economy in the wrong direction across all these fronts.

Calls for a $15 minimum wage are not new, of course. They became all the rage well before the pandemic began, with cities like Seattle and states like Maine, California, and New York already having moved toward such schemes.

The University of Washington,which has been tracking the policy’s effects in Seattle, concluding that the city’s path to $15 has so far led to a “9 percent reduction in hours” and a “6 percent drop in what employers collectively pay … for low-wage jobs.”

In San Francisco, the collateral damage continues. The East Bay Times reports that “upward of 60 restaurants around the Bay Area have closed” in the five-month period following the most recent hike. As a recent study in the Harvard Business Journal concluded, “The impact of a $1 rise in the minimum wage would increase the likelihood of exit for the median restaurant on Yelp (i.e., a 3.5 star restaurant) by around 0.055 percentage points, which is approximately 14 percent.”

The $15 minimum wage has failed in cities and states where the cost of living would seem to justify the increase. When enacted at a federal level, as Biden proposes, the results would only worsen, with wage controls serving to disrupt and interrupt an even wider and more diverse range of human relationships and economic signals.

“According to data from the Bureau of Labor Statistics, half of all workers in 20 states earned less than $18 per hour in 2019,” Strain writes. “In 35 states, the median hourly wage was less than $20. Setting a minimum wage so close to the median wage would price many workers out of the labor market. Indeed, in 47 states, 25% of all workers earned less than $15 an hour.”

When challenged on how such an increase would hurt small businesses, Biden quickly proceeded to tout the virtues of the Paycheck Protection Program, the bipartisan, $669-billion forgivable loan program. In doing so, Biden affirms what many already feared: that for a significant number of political leaders, such relief programs are not momentary “safety nets” but closed loops in an ongoing cycle of price distortion.

At a time when workers and businesses are enduring significant pain, the answers will not be found in manipulations of the market. Given that our current economic crisis is highly irregular and unpredictable, we ought to be focused on getting better and clearer price information, not further muddying the waters with top-down policy games.

Prices are not play things. When left alone from regulators and policymakers, they signal real insights about our creativity, behavior, and preferences. They provide a foundation for authentic human relationships, giving us the freedom and information needed to create and innovate, to trade and exchange, to restore and rebuild.

Whatever our goals for economic relief – whether we are trying to mitigate the pain of short-term losses, spur consumer spending, or avoid future inflation – viewing the economy as a machine to be programmed will not serve us well. Through a paradigm of social collaboration, however, much is possible. If we truly hope to empower people to provide for themselves while also boldly and freely meeting the needs of others, we will need free prices to do it.