The coronavirus bailout is the largest in U.S. history. While the bill will create a drag on the economy for years, an additional problem is that the massive influx of cash is ripe to become a sheer waste of taxpayer dollars. Fraud was widespread in the COVID-19 Economic Injury Disaster Loans and Paycheck Protection Program grants, and it continues to be a problem for the extra payments within unemployment insurance. Because the bailout is larger than any other in history, agencies were overwhelmed by the scope of the payments. The tendency toward waste in the coronavirus bailout is larger even than usual government programs.

The goal of the PPP was to help small businesses impacted by the shutdown so that they could continue to pay their employees. The outcome was very different. Five Atlanta business owners have been indicted for fraud, accused of setting up fake businesses and using the money to enrich themselves. In some cases, the defendants bought luxury cars with the loan. Allegedly, the businesses submitted false information such as forged bank statements and tax forms. After the loans were approved, the individuals transferred the funds to other shell companies. The SBA realized that the claims were fraudulent when they discovered all the claims had identical information, such as the number of employees. Many less clumsy attempts at fraud will surely go undetected.

Some companies which had revenue of more than $1 billion and were not eligible still received the loans. According to the Project on Government Oversight, “Atlantic Diving Supply, also known as ADS, Inc., obtained a PPP loan worth between $2 million and $5 million,” even though the company “raked in $1.25 billion in federal contracts so far this year.”

Under the PPP, businesses did not have to provide documentation or proof that they were materially harmed by the shutdown; they merely checked a box on a form. According to lawmakers, the goal of the program was to retain workers. But in the case of ADS, there is no indication that they were at risk of furloughing employees.

Not all fraud has been detected. The Attorney General of the Small Business Administration reported “potentially rampant fraud” in the EIDL Program. According to Bloomberg:

In some parts of the country the SBA approved far more $10,000 Economic Injury Disaster Loan (EIDL) grants than the number of eligible businesses, the analysis found. The epicenter was six adjacent congressional districts in the Chicago area, where 81,000 grants were approved even though there are only 19,000 eligible recipients. That’s more than $600 million going to phantom entrepreneurs.

These cases are not isolated, but form a larger picture of fraud. The Small Business Administration was forced into an impossible task. Either it could delay loans and create a pileup of unprocessed claims, or it could rush through authorizations and approve fraudulent claims. In reality, it did both. Thousands of businesses reported unprocessed or delayed claims, and watchdog organizations reported a high volume of fraud.

The FBI has reported a spike in unemployment fraud during the COVID-19 crisis. In many cases, benefits have gone to incarcerated or deceased individuals. Identity theft becomes more difficult to monitor, given the increased number of claims. Even before the current labor market disruptions, the U.S. Department of Labor estimated that more than 10% of its payments were fraudulent. Continuing to collect unemployment after returning to work is the most common type of unemployment fraud. Because so many people will return to work in the coming months, this type of fraud will certainly be more prevalent than usual.

Some fraud is present in any redistributive system, but with such a sudden and massive expansion, we are seeing fraud at extremely high rates. The examples provided here are only those that have been detected by federal agencies or reported by watchdog groups. Yet there are far too many claims for anyone to analyze where every dollar has gone. This massive experiment on the federal level should serve as a warning about future bailouts.

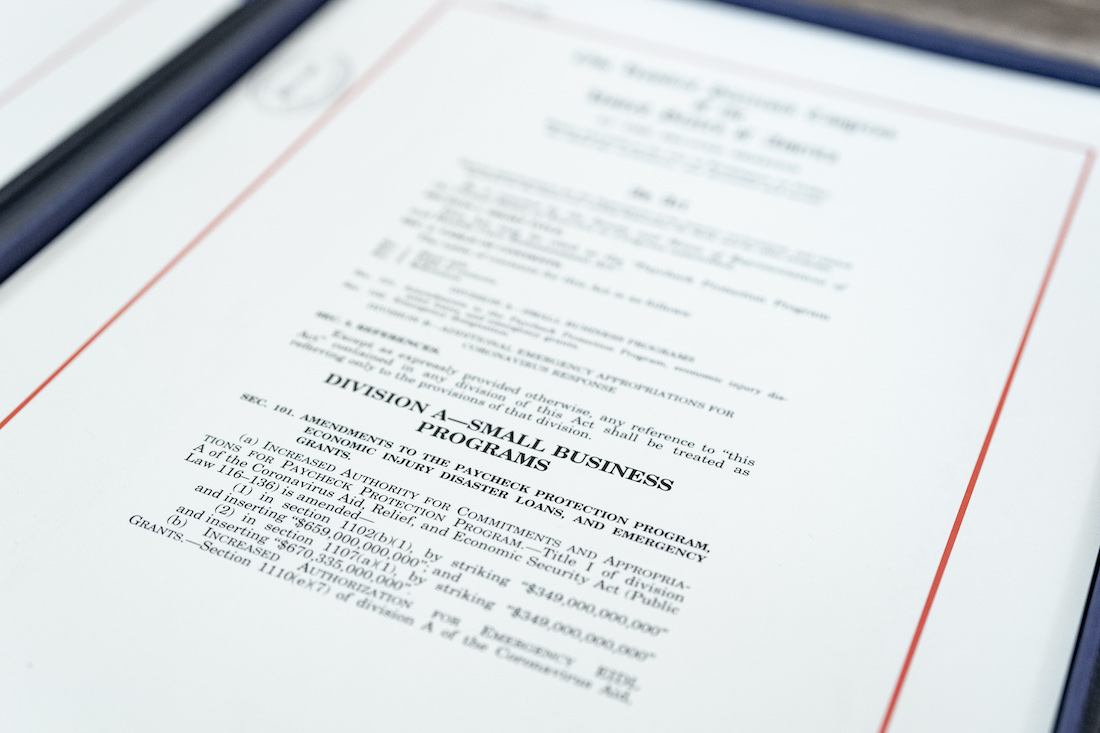

(Photo credit: The signing of the Paycheck Protection Program and Health Care Enhancement Act. White House. Public domain.)