Up to 20 forms of life are likely to survive a nuclear war: strains of bacteria, certain insects, and the myth of Nordic socialism. Despite those nations’ most dogged attempts to educate North Americans that they are not socialist, the idea that they present a model of “successful socialism” persists. Three new resources can deepen our understanding of the issue.

The first compares the tax rates of Sweden with the UK. True, the UK has slightly higher income inequality as measured by the Gini coefficient, and Sweden provides slightly more robust public services. However, Sweden provides this by squeezing the middle class with high taxes. Joakim Book of the Adam Smith Institute writes:

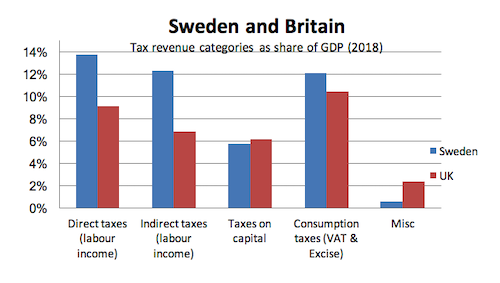

Britain also taxes its population less than does Sweden (35% of GDP as opposed to 44%), but comparing the reliance of various kinds of taxes as government revenues makes this even more clear. In the figure below I have mapped out tax revenues as share of GDP in four categories of income; the first two bars from the left are taxes on labour (direct income taxes as well as indirect ones like payroll/national contribution levies) the third taxes on capital and the fourth various consumption taxes.

This shows the taxation differences between Sweden and UK. As we would expect from income tax rates, labour incomes are much more heavily taxed in Sweden than in Britain. They don’t, however, exclusively or even predominantly apply to high-income earners. Sweden holds the European record for the lowest level where incomes are subject to direct taxation, at one-seventh of Britain’s remarkably high Personal Allowance (£12,500). Moreover, the elevated indirect taxes (payroll taxes) apply on even the lowest incomes, greatly contributing to why Sweden has among Europe’s highest cost of labour, while UK is below average on this – something that may explain the 2.5 percentage point lower unemployment rate in Britain.

These statistics are actually a reversal of a trend of centralized government that reached its apogee in Sweden in the 1970s and 1980s. David Bruining writes at FEE.org:

By the 1990s, government spending was up to 70 percent of GDP, and the debt to GDP ratio accumulated to 80 percent. Even the unemployment rate rose five percent. As soon as policymakers saw this socialist makeover gone wrong, things changed. In 1991, legislatures privatized parts of health care, introduced schooling vouchers, and cut back on money-wasting welfare programs. Between 1995 and 2000, the debt-to-GDP ratio was cut by 40 percent, and citizens earned more income thanks to the new 28 percent income tax. … Due to deregulation, Sweden has actually exceeded economic growth compared to all other European peers by at least one percent per year. This is not a result of progressivism or socialism. It is the opposite.

However, Sweden is not the Left’s favorite nation. “Bernie Sanders’ American Dream is in Denmark,” reported CNN. The third resource clarifies the situation in Copenhagen.

The Institute of Economic Affairs podcast “IEA Conversations,” posted on July 4, featured a conversation between IEA’s Director General Mark Littlewood and Martin Ågerup, president of the Danish free-market think tank CEPOS. Last year, CEPOS issued a report to clarify for the world that Denmark is not socialist. Ågerup unravels the myths and realities of economic life in Denmark in the podcast, which you can listen to below: