“Austerity is coming to an end,” Chancellor of the Exchequer Philip Hammond announced as he unveiled a budget laden with significant spending increases before the UK Parliament this afternoon. Here are the facts you need to know:

What are the total numbers?

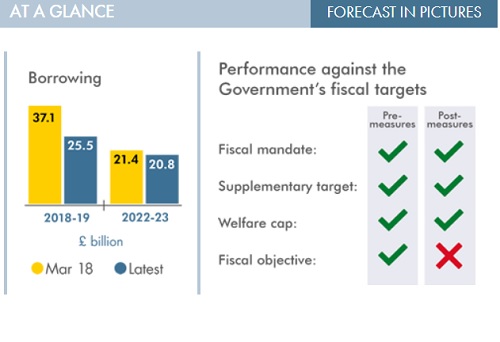

The budget includes £842 billion in Total Managed Expenditure (TME) for 2019-2020. Borrowing during the same time will reach £31.8 billion. Government spending will remain at a projected 38 percent of GDP for the next five years. “Over the next five years, total public investment is growing 30 percent, to its highest sustained level in 40 years, and will on average be an astonishing £460 million a week higher, in real terms, than under the last Labour government,” Hammond said. The deficit is forecast to fall to 0.8 percent of GDP by 2023-2024 fiscal year, down from 9.9 percent in 2009 and 1.9 percent in 2017-18.

What are the most significant aspects of the budget?

The budget demonstrates a marked increase in spending over the next five years, as well as other policy changes including:

- an £84 billion increase in NHS spending over five years, which was announced this summer;

- a massive boost to implement Universal Credit, as well as increasing the amount of money people may earn before losing benefits;

- a new Digital Services Tax on companies like Amazon;

- cutting personal taxes and decreasing the number of people who pay higher rate tax, one year ahead of schedule;

- half-a-billion pounds in Brexit emergency preparations;

- raising the National Living Wage;

- abolishing Private Financial Initiatives (PFIs) and Private Finance 2 (PF2) contracts for future projects;

- increasing spending on defence, counterterrorism, schools, mental health, and social care; and

- low estimates for future economic growth.

How large is the NHS funding increase?

“In June, [Prime Minister Theresa May] announced the single largest cash commitment to our public services ever made by a peacetime government: an £84-billion, five-year deal for our precious NHS, half as much again as the increase Labour offered the NHS at the last election,” Hammond said. It is a £20.5 million increase over the next five years.

How does the budget affect Universal Credit?

Universal Credit replaced a patchwork of government aid programs with one government benefits payment in the name of efficiency. However, it reduced the amount of money workers could earn before losing government benefits, and glitches at the program’s rollout left the program unpopular. “Universal Credit is here to stay,” Hammond said, and the budget doubles down on his promise. It allots £1 billion over the next five years to implement the program and another provision, which allows workers to earn an additional £1,000 a year without losing benefits, is expected to cost the Treasury £1.7 billion more.

What is the “Digital Services Tax,” and how does the budget address tax avoidance?

A national scandal erupted when Amazon, which earned £72.4 million in profits last year, paid only £1.7 million in taxes by following a government incentive to give its employees shares in its valuable stock. Hammond announced he will imposed a new Digital Services Tax on “established tax giants” who make at least £500 million in global revenue. The tax will take effect in April 2020 and is forecast to raise £400 million annually. The move had been endorsed by Archbishop of Canterbury Justin Welby, among others.

“It is only right that these global giants, with profitable businesses in the UK, pay their fair share towards supporting our public services,” Hammond said. He plans to squeeze another £2 billion that would have otherwise slipped through HMRC’s hands by tax avoidance and/or tax evasion. Hammond alluded to additional lobbying for OECD nations to take unified action to find “a globally agreed solution” to employers fleeing high-tax states.

How will personal income taxes be cut?

The Conservative Party delivered early on two promises in its manifesto: The Personal Tax Allowance will increase from £11,850 to £12,500 next April. (more than 1 million no longer paying taxes). A UK resident may earn £50,000 before meeting the Higher Rate Threshold, up from £46,350. The party’s manifesto pledged to meet these targets by 2020, accomplishing their goal one year early.

The reforms mean that 1.7 million Britons will no longer pay any personal income tax, and an additional million will pay a lower tax rate.

How does Brexit impact the 2018 budget?

Hammond acknowledged this week that his budget – the last before Brexit – assumes the UK will sign an “average-type free trade deal” with the European Union. However, he allocated an additional half-a-billion pounds for Brexit emergency preparations, in the event no deal emerges, and £2.2 billion for Brexit preparations overall. In such an event, Hammond said, he would have to “revisit” the entirety of the budget.

What is the prognosis for Private Financial Initiatives (PFIs) and Private Finance 2 (PF2) projects?

“I can announce that the government will abolish the use of PFI and PF2 for future projects,” Hammond said, “putting another legacy of Labour behind us.” PFIs became a point of controversy after the collapse of Carillion, a mammoth construction company that received £1.3 billion in new government contracts despite being designated as a “high risk” firm. Critics say these public-private partnerships represent a form of crony capitalism, with sweetheart contracts going to well-connected companies. For more background, see Philip Booth’s article on PFIs.

What about jobs, entrepreneurs, small businesses, and apprenticeships?

“This government has prioritised getting people into work because the best way to help people is to provide them with the stability of a pay packet every month,” Hammond said. The Office of Budget Responsibility (OBR) forecast the economy will add 800,000 jobs over the next five years, increasing labor force participation. To further employment growth, the government unveiled a £695 million package to support apprenticeships.

The budget also raises the UK’s minimum wage, the National Living Wage, by 38 pence from £7.83 to £8.21, beginning next April. OBR had already forecast wages would rise until 2023. Critics warn the National Living Wage actually reduces employment, especially for less educated and lower-skilled workers, and raises prices for consumers.

How does the budget deal with defence and national security?

The budget significantly increases spending for defence and national security. Hammond announced a £1 billion increase for the Ministry of Defence, as well as £160 in counter-terrorism training for local police forces, which face a metastasizing terrorist threat.

What about environmental or other “sin taxes”?

Hammond announced the government will impose a new tax on all plastic packaging that includes less than 30 percent recycled material; however, the implementation has not yet been determined.

He is also freezing fuel taxes for the ninth year in a row, saving £1,000 for each car driver and £2,500 for everyone driving a van. The government duty on beer, cider, and spirits will be frozen for another year. But the tobacco tax will rise at the rate of inflation plus two percent. Wine duty will increase, as anticipated, and white ciders will be taxed at a new, higher rate. “Sin taxes” create unforeseen consequences, like smuggling that finances criminal gangs and even terrorist organizations, if they are too high.

What is the outlook for overall economic growth during the next five years?

GDP growth is forecast to remain between 1.3 and 1.6 percent until 2023.

Does this budget actually end “austerity”?

“Under this Conservative government, austerity is coming to an end, but discipline will remain,” Hammond said, contrasting the Tories with “the Corbyn Party.” Free-market advocates would debate whether “austerity” properly describes UK budgets since 2010. Meanwhile, Labour Party leader Jeremy Corbyn dismissed the budget as a collection of “half-measures and quick-fixes.”

The 2018 budget certain spends more money. Government tax receipts came in higher than expected by the last public forecast, the Spring Statement; however, the new budget anticipates the debt levels will remain virtually identical. Theresa May’s government is spending the difference, rather than paying off the nation’s £1.8 trillion national debt.

Why should Christians care about a national budget?

The national budget significantly impact the national and personal well-being of all citizens. The Lord commanded the prophet Jeremiah, “Seek the welfare of the city where I have sent you into exile, and pray to the Lord on its behalf, for in its welfare you will find your welfare” (Jeremiah 29:7, ESV). Christians should support policies that increase national prosperity, benefit families, and encourage people to use their God-given gifts for productive ends.

This budget is of particular interest, as the intervention of Archbishop of Canterbury Justin Welby appears to have resulted in the government creating a new tax to quell public outrage. This indicates the importance of Christian leaders speaking out on the moral aspects of economics and may augur new outcries against companies resisting paying a tax level individual prelates deem “sufficient.”

(Photo credit: UK Office of Budget Responsibility. This photo has been modified. Public domain.)