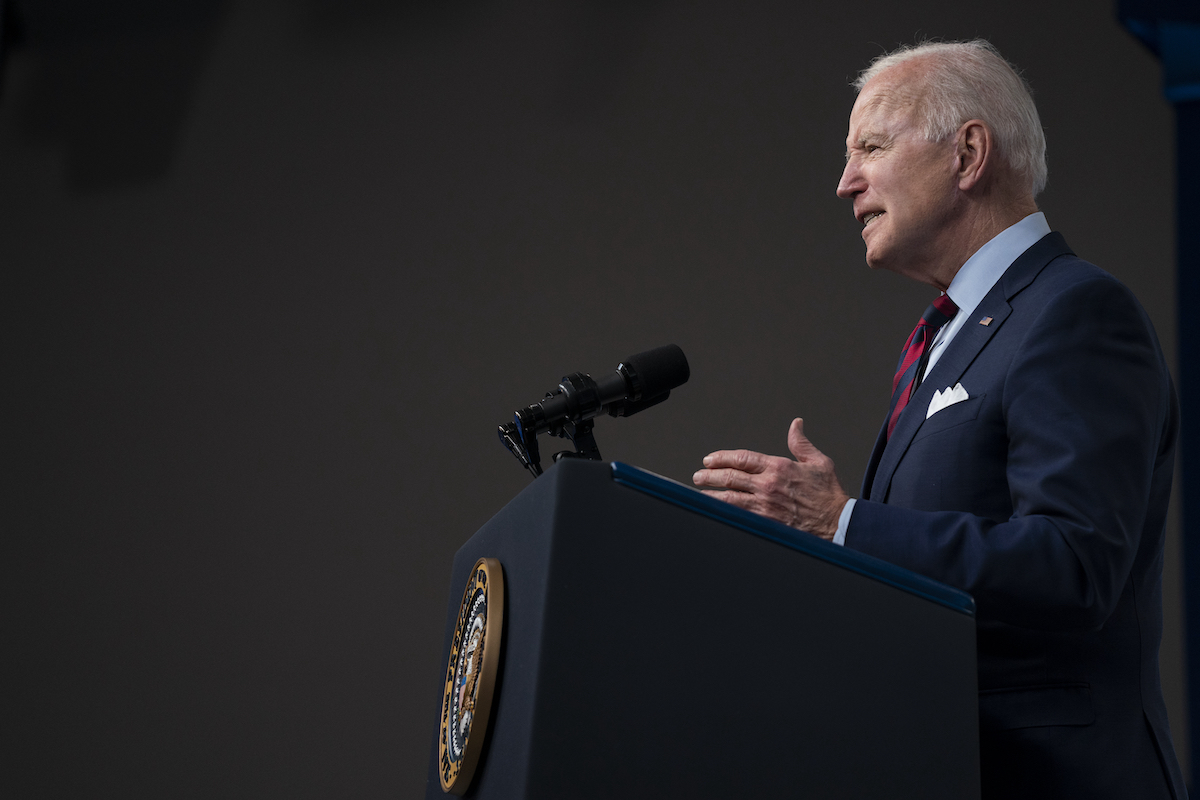

If anyone had any lingering doubts about where American economic policy is heading over the next four years, those should have been removed by President Joe Biden’s proposed $6 trillion budget for 2022. Whatever Congress does with this proposal, there’s no doubt that government is now viewed by leading policymakers and, judging from recent surveys, by millions of Americans as the primary engine that should be driving the economy.

Whether it is the disinterest in the implications of America’s public debt levels exceeding those of World War II, or the confidence that government-spending is central to growing the economy, we are witnessing a return to many of the orthodoxies which characterized postwar economic policy until the late-1970s. The label applied to those orthodoxies is “Keynesianism.”

By that, I don’t mean that people in the White House or the Treasury Department are eagerly devouring John Maynard Keynes’ famous 1936 book “The General Theory of Employment, Interest and Money” or embracing every idea advanced by the neo-Keynesians who occupied economics departments and finance ministries the world over from the late-1940s onwards.

Rather, I’m referring to two things. The first is a rejection of supply-side economics: the idea that long-term economic growth is best secured by lowering taxes, reducing regulation, and diminishing trade barriers. This goes hand-in-hand with departure from the skepticism about state economic intervention that held sway — at least rhetorically — from the 1980s until the 2008 financial crisis.

Disillusionment with these ideas began gaining traction following the Great Recession and thereafter acquired growing momentum. This leads us to the second phenomenon marking our present Keynesian moment: the growing faith in the state which crisscrosses today’s political spectrum.

On the right, economic nationalists want greater use of industrial policy. These are targeted government interventions which seek to foster, reorient or protect particular economic sectors. The same people appear supportive of the Biden Administration’s continuation of the protectionist positions advanced during Donald Trump’s presidency.

Some don’t hide their admiration of the Communist China’s state capitalism model.

Meanwhile, on the left, progressives ranging from Sen. Elizabeth Warren to Harvard economist Jeffrey Sachs are saying America should be more like your average European social democracy, wherein the state intervenes at every stage of economic life — from cradle to grave — in an effort to engineer greater economic equality.

Many are also proponents of “stakeholder capitalism” (the idea that profit is just one of several goals to be pursued by business). That movement has become extremely influential. Even the U.S. Chamber of Commerce has embraced much of its agenda.

But what, you might ask, does all this have to do with a British economist who died 75 years ago?

The answer lies not so much in the details of postwar policies, or even many of the ruminations of Keynes himself. It’s a question of the mindset policymakers bring to the economy.

In simple terms, Keynes put great stock in top-down planning. I’m not referring here to outright socialism. Instead, the Keynesian outlook means believing that government institutions can and should manage the economy without completely taking it over.

The means which they employ to do so include high-levels of government spending, extensive regulation and, if necessary, pumping purchasing power into the economy via heavy deficit-spending and keeping interest rates low. The goal is to constantly prod and poke people’s economic actions in ways that smooth (if not avoid altogether) the boom-bust cycle, promote steady growth and deliver more equal economic outcomes.

One problem with this strategy is that it’s impossible for governments to know and absorb all the information that they would need to know and absorb if they were to pursue this process successfully and permanently. Failure to accept this means that Keynesian-style economic planning can’t help but make significant mistakes. That’s why most adventures in industrial policy are usually ineffectual or downright disastrous.

The effects of such errors might not be apparent in the short-to-medium term. Yet they will manifest themselves over the long run — big time. Consider, for example, how federal government meddling in the housing market in the late-1990s combined with the Federal Reserve keeping interest-rates too low for too long between 1999 and 2005 contributed to the 2008 financial crisis and the subsequent brutal recession.

Another criticism of these approaches is that they gradually reduce the scope for people’s economic freedom. Again, I’m not talking about the severe constraints that characterized Eastern European command economies. I’m referring to the impositions that grow over time as governments constantly seek to stimulate the pace of economic growth and shape the form which it assumes.

To these criticisms, those with Keynesian outlooks would respond that governments have a responsibility to manage the economy and, in doing so, pursue particular goals. The alternative, they say, is to accept intolerably wide wealth-disparities, the social tensions which go along with these and the shocks generated by boom and bust. Such results, Keynes himself argued, can’t help but fuel the extremes of left and right and thereby threaten constitutional democratic government.

I happen to find such defenses of Keynesian-style managed economies deeply unconvincing. That, however, is not the point. What’s significant is that American economic policy is increasingly shifting in this direction and many Americans are perfectly OK with it.

The problem facing advocates of supply-side economics is that once elite and public opinion head in a particular direction, they are hard to reverse. Indeed, it’s likely that only a major crisis would open up major opportunities for shifting economic policy decisively back towards the market.

A major factor driving the move away from America’s postwar neo-Keynesian consensus was stagflation: the nightmare of high inflation, low growth and high unemployment which engulfed Western nations in the 1970s. This crisis discredited Keynesian economic prescriptions and created conditions in which policymakers and everyday Americans began taking seriously the case for market liberalization.

Crises, however, don’t happen very often, and many people get hurt in the process.

America is now crossing an economic Rubicon.

I’m confident that if this doesn’t encounter determined opposition, then, at some point in the future, the dysfunctionalities associated with trying to manage economies will return with a vengeance.

That’s one bad déjà vu no-one should want America to endure.

This article originally appeared in The Detroit News on June 2, 2021